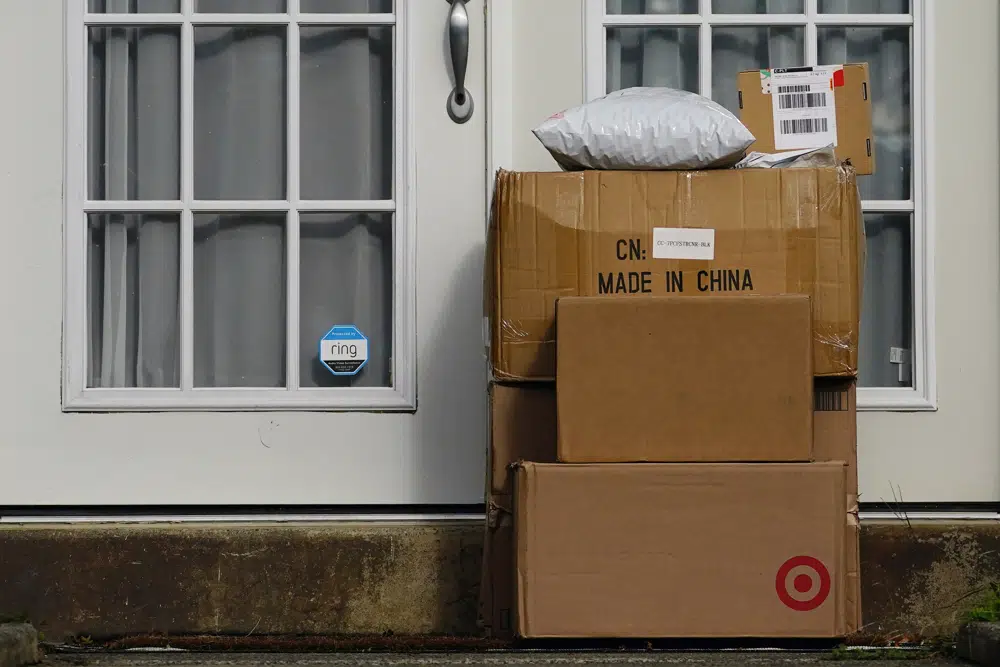

Conservatives in the United States see China as a significant economic adversary, and they are now targeting their efforts on a trade issue that has been a priority for both labor unions and progressives. Specifically, they seek to address the significant increase in duty-free packages coming into the country from China.

If this effort succeeds, e-commerce businesses and consumers importing products valued at less than $800 from China will be affected, and it could result in further strain on the already-tense relations between the two countries.

The de minimis rule, under current U.S. law, allows most imports valued at less than $800 to enter the United States duty-free, provided they are packaged and addressed to individual buyers. This rule, which has been in place for some time, is now becoming a focal point for a significant trade dispute in Congress. Efforts to lower the threshold amount or exclude certain countries from duty-free treatment are set to ignite a major debate.

John Drake, a vice president at the U.S. Chamber of Commerce, has highlighted that the de minimis rule has become a symbol for various concerns surrounding China and other trade-related challenges. He strongly advocates for the preservation of the existing U.S. law.

The significance of this trade fight cannot be understated, as it has far-reaching implications for the U.S. economy, international trade relations, and consumer interests. Supporters of maintaining the current de minimis rule argue that it promotes economic growth, enables access to a wide range of affordable goods, and fosters competition.

On the other hand, opponents believe that lowering the threshold or excluding certain countries would protect domestic industries, safeguard jobs, and address potential security risks.

As this debate unfolds in Congress, it is crucial for policymakers to carefully consider the potential consequences of any changes to the de minimis rule. Balancing the interests of businesses, consumers, and national security concerns will be a complex task. Striking the right balance will require a thorough examination of the economic and geopolitical implications, as well as an understanding of the long-term effects on various stakeholders.

This has resulted in more small-value shipments being able to enter the country without additional fees or charges, boosting cross-border e-commerce and giving consumers access to a wider range of goods at lower prices.

The de minimis rule has also allowed customs officials to focus their resources on larger, higher-value items, increasing efficiency and reducing delays at ports of entry. Overall, the rule has been an important driver of economic growth and consumer welfare, and its continued expansion could further benefit U.S. businesses and consumers alike.

The significant rise in the volume of small-value imports benefiting from the de minimis rule has led to concerns regarding security and revenue loss. With an estimated 771 million packages in 2021, many of which come from China, there is increasing scrutiny over the contents and value of these packages.

Some critics argue that the rule may be exploited by foreign sellers who can now easily send inexpensive products into the country without incurring tariffs or fees.

Former U.S. Trade Representative Robert Lighthizer has expressed concerns about the lack of oversight on these packages, warning that the U.S. government is unable to track what is in them or their true value. This could potentially lead to security risks, as well as a loss of revenue for the federal government.

As such, there are calls for greater transparency and tracking measures to ensure that the de minimis rule is not abused and that the safety and security of the country are not compromised.

Lighthizer’s recommendation to eliminate or reduce the de minimis rule has been echoed by other critics who argue that foreign companies are exploiting the loophole and hurting American businesses.

Some have called for stricter regulations and oversight on small-value imports, while others have proposed banning Chinese-made goods from benefiting from the special treatment for lower-cost goods altogether.

Last year’s efforts by House Democrats to prohibit Chinese-made goods from the de minimis rule’s benefits was part of a larger measure aimed at boosting investments in semiconductor manufacturing and research.

While this proposal did not gain much traction at the time, it highlights the increasing concerns around the de minimis rule’s impact on American businesses and the potential security risks associated with the influx of small-value imports. As debates around trade policy continue, the future of the de minimis rule and its place in U.S. commerce remain uncertain.

The political dynamic around the de minimis rule has shifted quickly in recent months. While the Biden administration and Democratic leaders originally abandoned provisions aimed at reducing the threshold for duty-free shipments due to opposition from business groups and key Republican members of Congress, a new House committee focused solely on China is now recommending legislation to reduce the threshold with a focus on foreign adversaries, including China.

The committee’s recommendations have been driven by rising concerns over national security and economic threats posed by China, as well as the impact of the de minimis rule on domestic businesses. This new development suggests a growing bipartisan consensus around the need for stricter regulations on small-value imports, particularly those originating from China.

The fate of this legislation remains to be seen, but the increasing focus on the de minimis rule and its impact on American commerce and security underscores the evolving landscape of U.S.-China relations and the challenges facing policymakers as they seek to balance economic interests with national security concerns.

The Select Committee on the Chinese Communist Party has expressed concerns about the exploitation of the $800 threshold by Chinese companies selling goods directly to American consumers as a way to circumvent U.S.

laws designed to prevent the sale of goods made with forced labor. According to the committee’s report, Customs and Border Protection faces significant challenges in scrutinizing goods sent under the $800 threshold for forced labor concerns due to the sheer volume of products coming in.

The committee’s focus is on retailers Temu and Shein, which it claims are responsible for over 30% of all de minimis shipments entering the U.S. each day, or nearly 600,000 a day last year.

The report further highlights that U.S. retailers such as Gap and H&M paid significant import duties in 2022, while virtually all of the goods sold by Temu and Shein were shipped using the de minimis exception, resulting in no duty payable.

These findings underscore the growing concerns around the impact of the de minimis rule on U.S. businesses, national security, and compliance with labor laws.

As lawmakers continue to explore ways to address these issues, it is becoming increasingly clear that changes to the de minimis rule will be a crucial part of any long-term strategy to promote economic growth and protect American interests.

The shift in mindset around the de minimis rule is also reflected in proposed legislation. The Senate has introduced two bills addressing the issue this month.

One, from Sens. Sherrod Brown, D-Ohio, and Marco Rubio, R-Fla., would prevent expedited tariff-free treatment of imports from certain countries, primarily China and Russia. The other, from Sens. Bill Cassidy, R-La., and Tammy Baldwin, D-Wis., would reduce the threshold for duty-free treatment to the level that other nations use, impacting all trade partners, not just China and Russia.

The bills indicate a growing consensus that the de minimis rule has unintended consequences that are impacting domestic businesses and national security.

As lawmakers continue to debate the issue, it is clear that changes to the rule will be on the table, and a new balance will need to be struck between consumer access to products and protecting American interests. The next few years are likely to be pivotal for trade policy and commerce in the U.S.

The Cassidy-Baldwin bill proposes reducing the threshold for duty-free treatment to the amount used by other nations, such as Belgium, which uses the European Union threshold of 150 euros ($165 at current exchange rates).

The bill would require the U.S. to reciprocate and use the same threshold when determining whether goods coming in from countries like Belgium get duty-free and expedited treatment.

Sen. Cassidy pointed out that President Trump had reframed the argument for Republicans on trade with China, citing China’s use of subsidies and forced labor to take American jobs.

These factors have led to a renewed focus on the de minimis rule and its impact on American businesses and national security.

Last year, business groups like the Chamber of Commerce and the National Association of Manufacturers opposed the de minimis trade provision in the semiconductor bill, warning that it would pose a significant cost to American businesses and consumers and exacerbate supply chain disruptions.

While concerns around these issues are valid, the shift in political thinking around the de minimis rule suggests that policymakers may be more willing to consider changes to the threshold in the future.

Opponents of reducing the de minimis threshold argue that it would represent a significant tax increase for many U.S. small businesses and result in additional administrative costs, such as the need to hire a customs broker to process shipments.

According to Drew Drake, senior vice president of government relations for the National Taxpayers Union, there was a reason why Congress raised the level to $800 in 2016, as it recognized the benefits of the de minimis rule for American businesses and the limitations of collecting duties on low-value shipments.

Proponents of reducing the threshold argue that the current system is being abused by foreign companies, particularly those in China, and poses a significant risk to national security and compliance with labor laws.

While the fate of any proposed changes to the de minimis rule remains uncertain, it is clear that the issue will remain a point of contention in the ongoing debate around U.S. trade policy and its impact on domestic businesses, consumers, and national security.